In today’s ever-evolving business landscape, companies are increasingly recognizing the importance of sustainable practices and responsible investing.

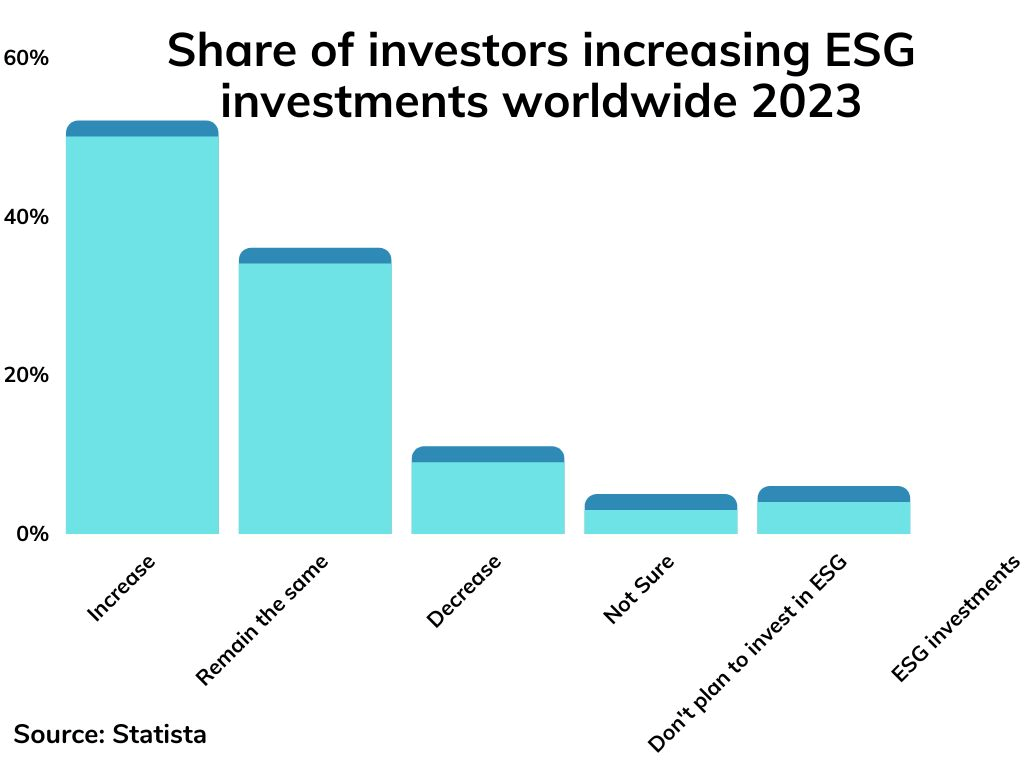

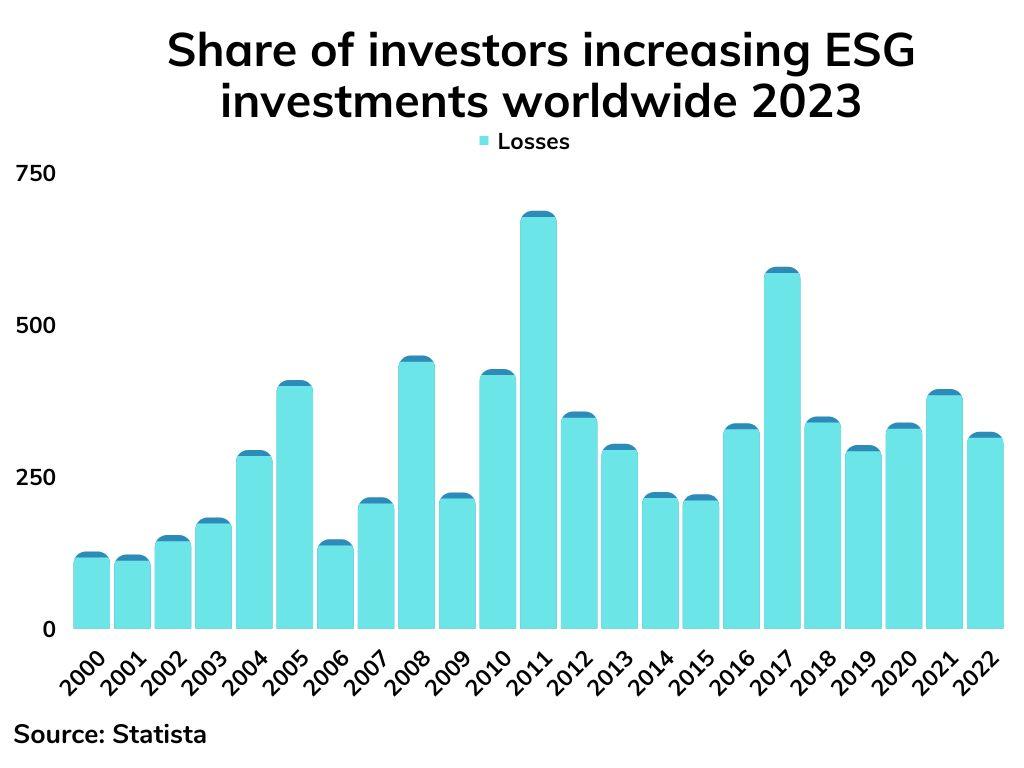

As a result, ESG (Environmental, Social, and Governance) investing has gained significant traction in recent years. In fact, a 2023 survey revealed that 50% of professional investors worldwide intend to raise their allocation of ESG investments” in the coming years.

For those wondering what ESG stands for, here’s a simple answer: ESG is an acronym denoting environmental, social, and governance considerations in investments. These three components within the ESG framework are acknowledged as the foundational pillars for corporate reporting. ESG’s overarching objective is to identify all the non-financial risks and opportunities that are part of a company’s routine operations.

In short, ESG is the framework used by investors to assess the impact of their investments on the environment, community, and society in which they operate.

Now that we have covered the basics of what does ESG stand for, let’s delve deeper into ESG investing, ESG factors, ESG KPIs, ESG data collection, and how businesses can effectively track and report on their ESG performance. Additionally, we would also take a closer look at different ESG frameworks and what they offer.

Let’s begin by understanding ESG Investing.

What is ESG Investing?

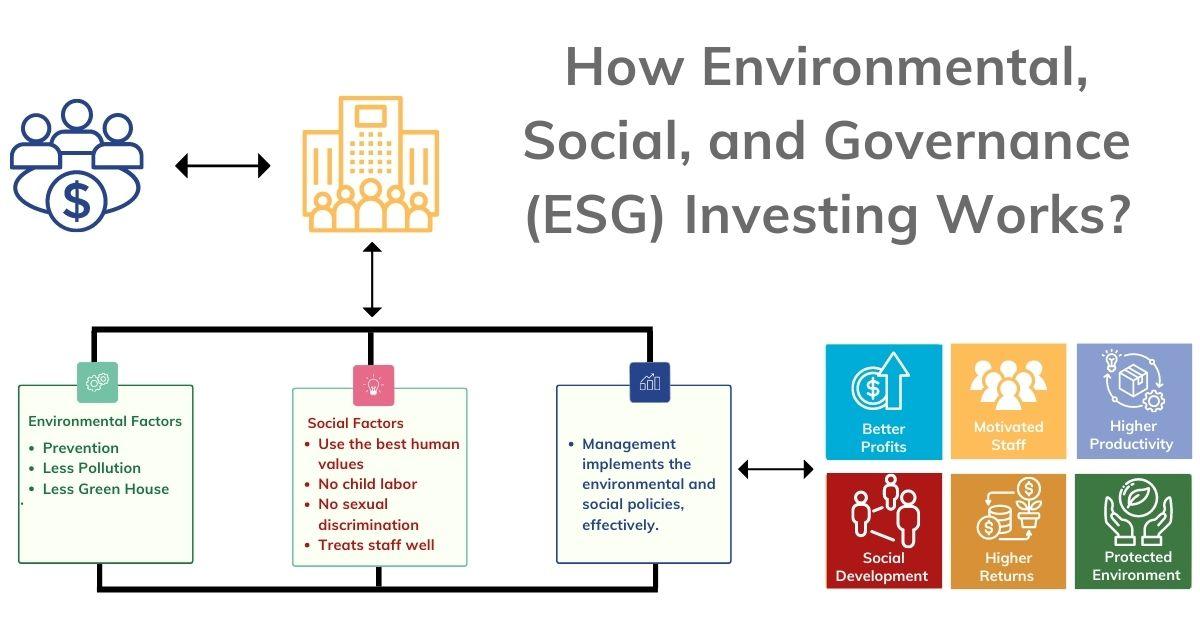

ESG investing is a strategy that takes into account environmental, social, and governance factors when evaluating investment opportunities. The goal is to identify companies that demonstrate a commitment to sustainability, ethical practices, and strong corporate governance.

In capital markets, investors use the ESG criteria to assess companies and make their investment plans, a practice commonly referred to as ESG investing.

While many investors link ESG Investing to Sustainable Investing, the two terms are interrelated as actions and their impact.

ESG factors, in essence, examine how a company’s leadership and stakeholders make key decisions, while sustainability evaluates the impact of those decisions on the global landscape.

Companies embracing ESG factors and integrating them into their business processes gain numerous long-term benefits beyond attracting investors’ attention. By implementing sustainable business practices and compliance with social and environmental causes, these companies cultivate strong bonds with various stakeholders, including their clients, employees, communities, and regulatory bodies. Adherence to ESG factors enhances companies’ brand reputation, reduces business risks, creates new marketing opportunities, and ultimately increases their long-term value.

ESG investing goes beyond purely financial considerations and aims to align investments with the values and principles of investors.

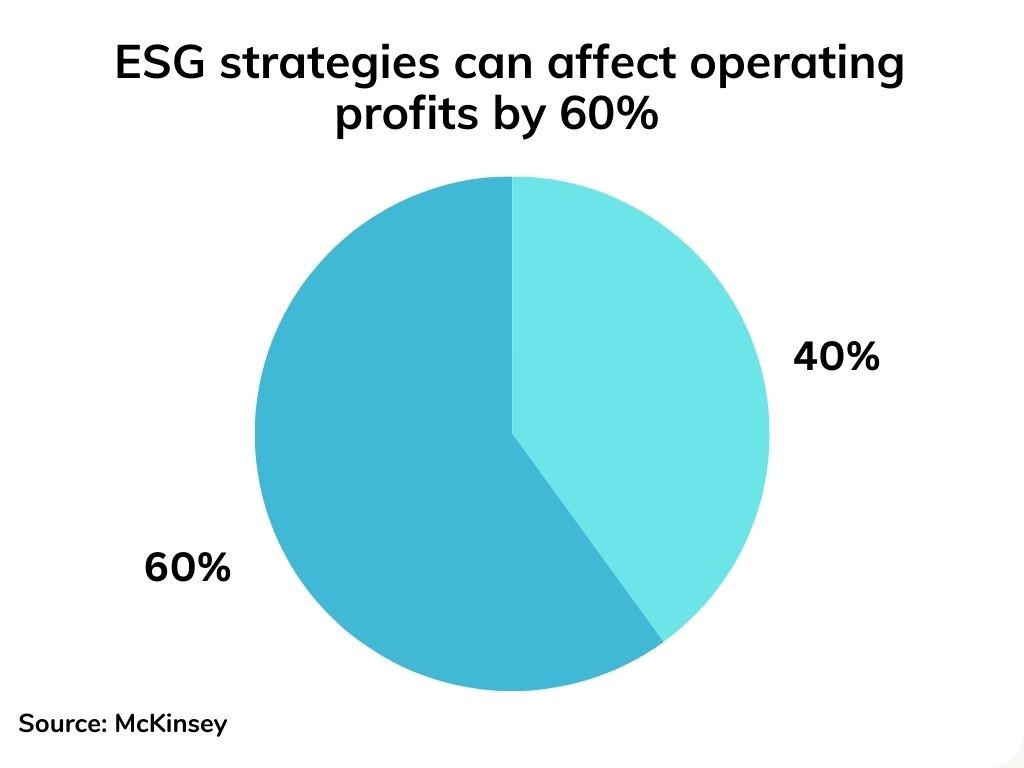

However, this doesn’t mean that ESG investing doesn’t drive operating profits. In fact, ESG investment strategies can have a 60% impact on operating earnings.

Championing the cause of ESG standards can result in rewards for both enterprises and their shareholders. However, a lapse in ESG adherence can significantly impair a company’s finances and market performance. Therefore, it’s vital for companies to be proactive and integrate key environmental, social, and governance (ESG) factors in all their investment decisions.

Key ESG Factors

When considering ESG investing, it’s essential to understand the key factors that influence ESG investing decisions.

Image Source: United Nations

- Environmental Factors: Environmental considerations assess a company’s impact on the environment. This includes factors such as carbon emissions, waste management, resource usage, and renewable energy practices. Environmental factors have a huge impact on the operating costs of an organization. In fact, the losses that occurred due to climate-related disasters worldwide amounted to 313 billion U.S. dollars in 2022. Quite naturally, companies that prioritize environmental sustainability are more likely to attract ESG-minded investors.

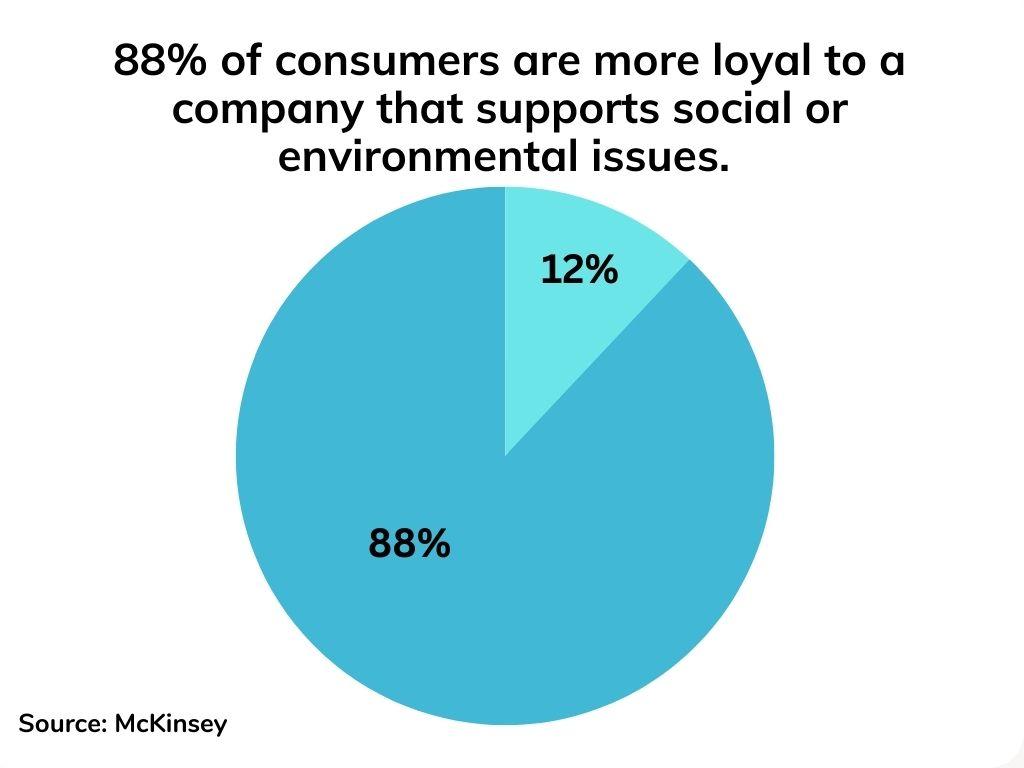

- Social Factors: Social factors focus on a company’s impact on society and its stakeholders. This encompasses factors such as labor practices, human rights, diversity and inclusion, community engagement, and product safety. Companies that prioritize social responsibility are more likely to be attracted to ESG investing. You’ll be surprised to know that businesses that support social causes increase consumer loyalty by 88%.

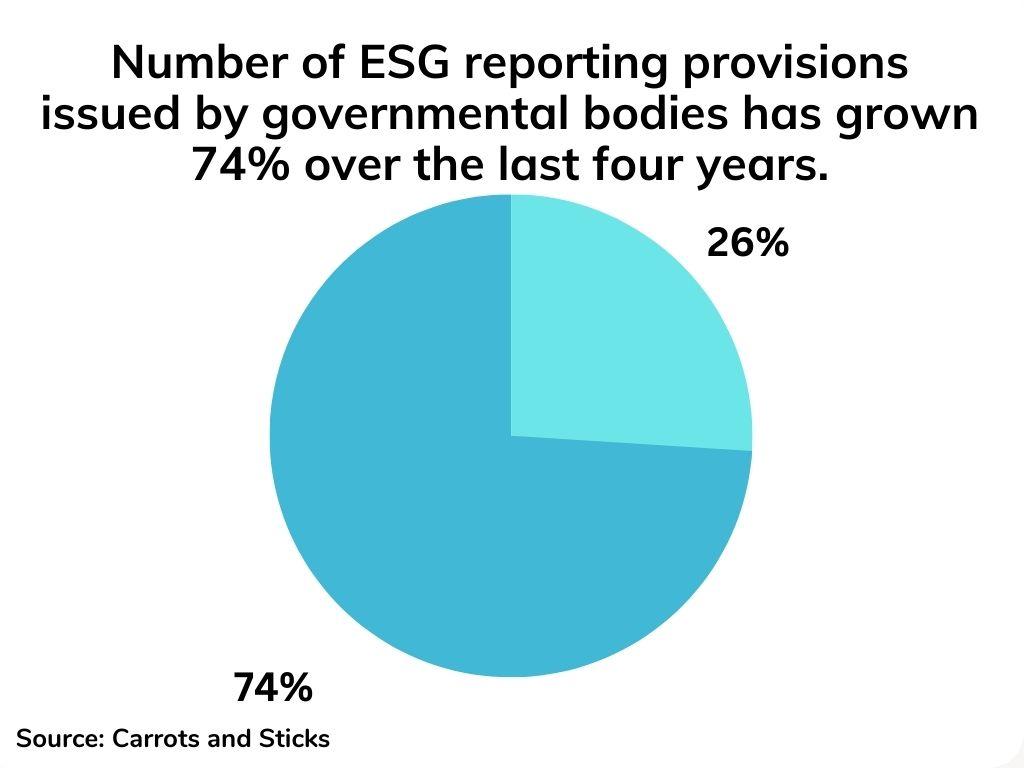

- Governance Factors: Governance factors evaluate a company’s leadership, internal controls, and overall governance structure. This includes factors such as board composition, executive compensation, shareholder rights, and transparency. Companies with strong governance practices are more likely to instill confidence in ESG investors.Over the last 4 years, the number of ESG reporting provisions issued by governmental authorities has increased by 74%.

How Does Environmental, Social, and Governance or ESG Investing Work?

ESG investing refers to the process of incorporating environmental, social, and governance considerations into the selection of investments. This is done through various approaches, including exclusionary screening, inclusionary screening, and active ownership.

- 1. Exclusionary Screening:This approach involves excluding certain industries or companies from the investment portfolio based on specific ESG factors. For example, an investor may choose to exclude companies involved in fossil fuel extraction or those with poor labor practices.

- 2. Inclusionary screening focuses on actively selecting companies that meet specific ESG factors. This approach seeks to invest in companies with strong ESG performance and positive sustainability practices.

- 3. Active Ownership: Active ownership entails actively engaging with companies in which investments are made. This may involve dialogue with company management, voting on shareholder resolutions, and advocating for improved ESG practices.

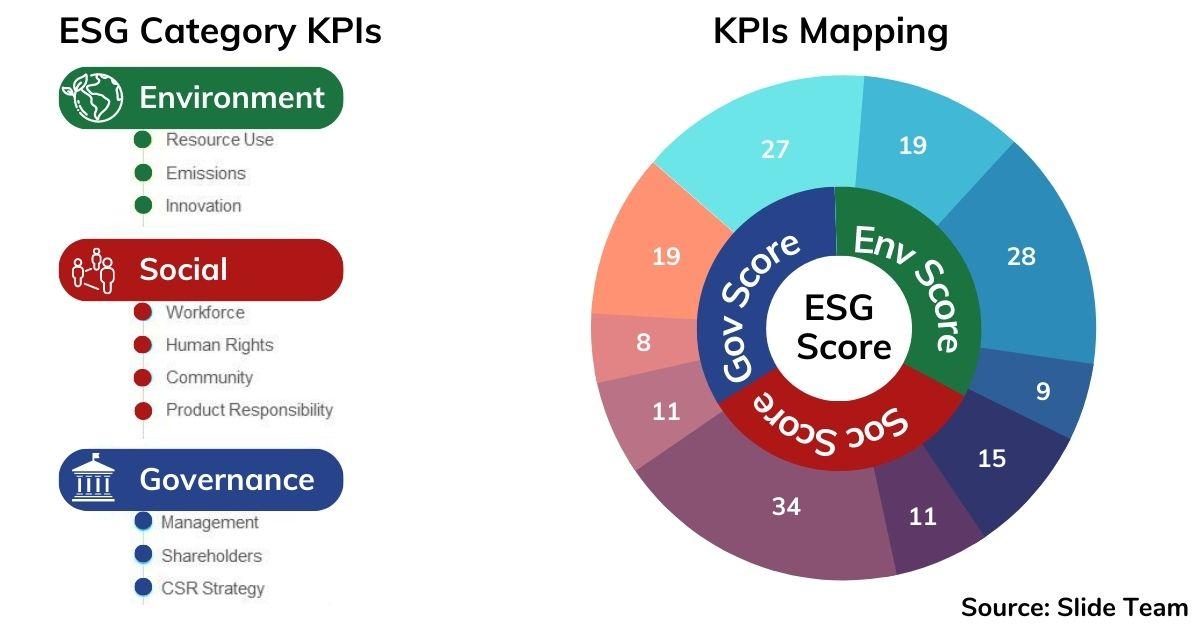

What is an ESG KPI?

ESG KPIs (Key Performance Indicators) are metrics used to measure and track a company’s environmental, social, and governance performance. These ESG KPIs provide valuable insights into a company’s sustainability practices and can be used to evaluate its ESG performance over time. By tracking ESG KPIs, businesses can identify areas for improvement and demonstrate their commitment to sustainable practices.

Critical ESG KPIs You Must Be Aware Of

When it comes to tracking ESG performance, there are several critical KPIs that businesses must be aware of. These include:

- 1. Carbon Footprint: This ESG KPI measures the amount of greenhouse gas emissions produced by a company. It provides insights into a company’s environmental impact and its efforts to reduce carbon emissions.

- 2. Employee Turnover Rate: This ESG KPI measures the rate at which employees leave a company. A high turnover rate may indicate poor employee satisfaction, which can impact a company’s social performance.

- 3. Board Diversity: This KPI measures the diversity of a company’s board of directors in terms of gender, ethnicity, and other demographics. It reflects a company’s commitment to diversity and inclusion. A study conducted by McKinsey & Company revealed that companies boasting diverse leadership teams often surpass their financial performance compared to their counterparts.

- 4. Executive Compensation Ratio: This KPI compares the compensation of top executives to the average employee’s compensation. It provides insights into a company’s governance practices and the fairness of its compensation structure.

ESG Frameworks & Their Types

ESG frameworks are structured guidelines that establish a methodical approach to assess and report a company’s non-financial performance. These frameworks gauge how effectively a company integrates ESG considerations into its operations and decision-making procedures.

They present a standardized methodology for evaluating and disclosing a company’s performance in environmental, social, and governance dimensions. By providing a shared lexicon and a consistent set of metrics, ESG frameworks facilitate uniform assessments of ESG practices. This uniformity benefits investors, stakeholders, and regulatory bodies as it simplifies the evaluation of a company’s sustainability initiatives.

Companies frequently employ ESG frameworks for comparative analysis against industry peers and to identify areas in need of enhancement. These frameworks assist organizations in defining ESG-related objectives, monitoring progress, and enhancing the transparency of their reporting. Furthermore, ESG frameworks offer investors valuable insights into the sustainability and ethical facets of potential investments.

Types of ESG Frameworks

- Benchmark Framework

Benchmark frameworks provide a basis for comparing and evaluating organizations’ ESG performance.

a. CDP (Carbon Disclosure Project): CDP focuses on carbon emissions and climate risks, collecting data from companies worldwide. It allows benchmarking of environmental performance, aiding investors and stakeholders in assessing climate change mitigation efforts

b. GRESB(Global Real Estate Sustainability Benchmark): GRESB assesses ESG performance in real asset investments like real estate and infrastructure. It benchmarks sustainability, helping investors and property companies improve environmental and social practices.

- Voluntary Framework

Voluntary frameworks offer guidelines for organizations to voluntarily disclose and improve their ESG performance.

a. GRI (Global Reporting Initiative): GRI provides comprehensive sustainability reporting guidelines, enabling organizations to disclose environmental, social, and governance impacts. It supports voluntary reporting and transparency efforts.

b. TCFD (Task Force on Climate-related Financial Disclosures): TCFD focuses on climate risks and provides guidelines for disclosing climate-related financial information. It encourages voluntary transparency regarding climate impact and risk management

- Regulatory Framework

Regulatory frameworks involve mandatory requirements imposed by governments or regulatory bodies.

a. SFDR (Sustainable Finance Disclosure Regulation): SFDR is a European Union regulation mandating financial firms to disclose ESG information in their investment products. It aims to enhance transparency and sustainability in financial markets.

b. CSRD (Corporate Sustainability Reporting Directive): CSRD, also EU-based, will require companies to report sustainability information, expanding ESG disclosure obligations. It seeks to harmonize sustainability reporting and enhance corporate transparency.

ESG Data Collection Best Practices

To effectively track and report on ESG KPIs, businesses must establish robust data collection practices. Let’s take a look at some ESG data best practices:

- 1.Define Data Collection Methodology: Clearly define how ESG data will be collected, including the sources, frequency, and responsibility for data collection.

- 2.Standardize Data Collection: Establish standardized ESG data collection templates and processes to ensure consistency and comparability of ESG data across the organization.

- 3.Automate Data Collection: Leverage technology solutions to automate data collection processes and reduce manual effort. This can help streamline data collection and improve data accuracy.

- 4.Verify Data Quality: Regularly verify the quality and accuracy of collected ESG data to ensure its reliability for reporting purposes.

How to Start Tracking ESG KPIs?

Getting started with tracking ESG KPIs can be a daunting task, but with the right approach, it becomes more manageable. Here’s how to get started:

- 1.Identify Relevant ESG KPIs: Determine which ESG factors and KPIs are most relevant to your business based on your industry, stakeholder expectations, and sustainability goals.

- 2.Establish Baseline Data: Gather historical data on the identified ESG KPIs to establish a baseline for future comparison. This will provide insights into your current performance and areas for improvement.

- 3.Implement Data Collection Processes: Set up data collection processes to gather the required data for tracking ESG KPIs. This may involve leveraging existing systems, implementing new tools, or engaging third-party providers.

- 4.Track and Monitor Performance: Regularly track and monitor your performance against the identified ESG KPIs. This will enable you to identify trends, track progress, and take corrective actions if necessary.

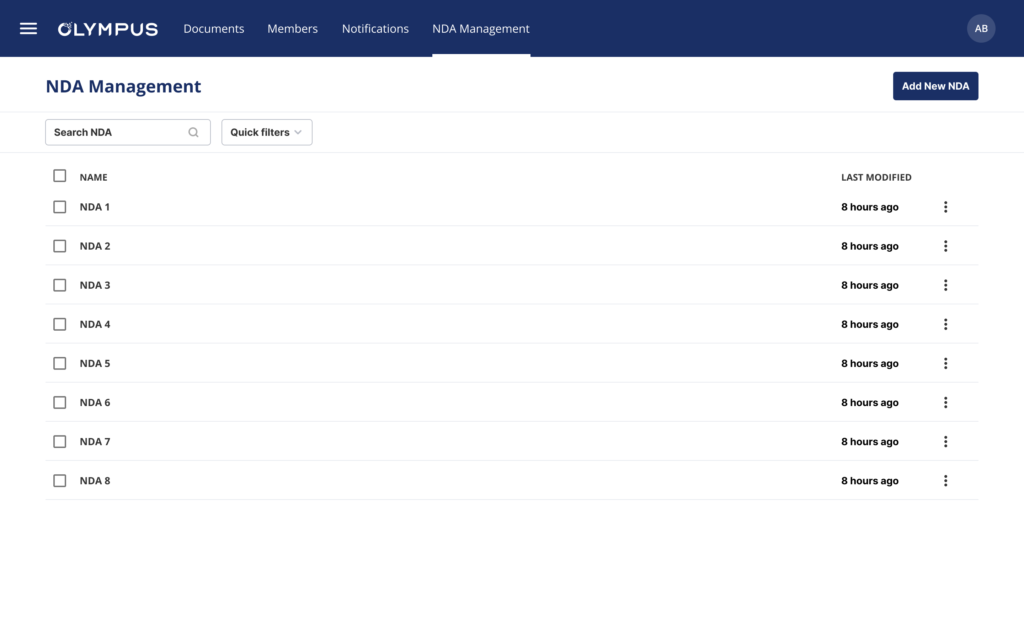

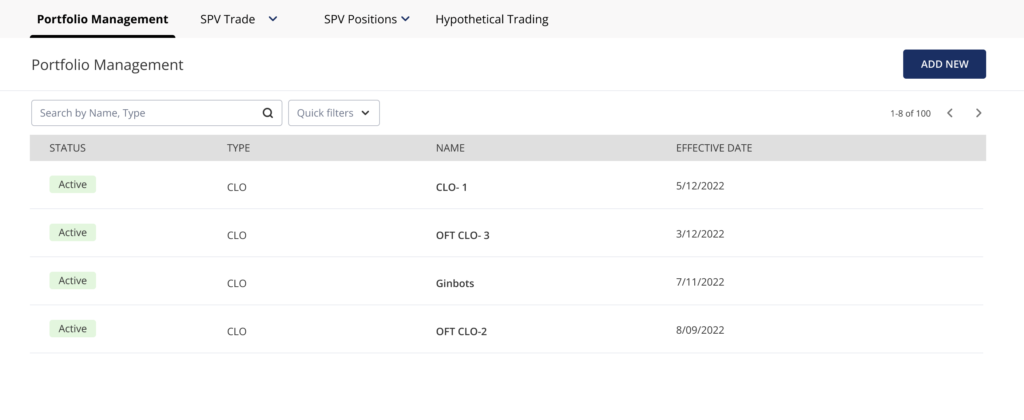

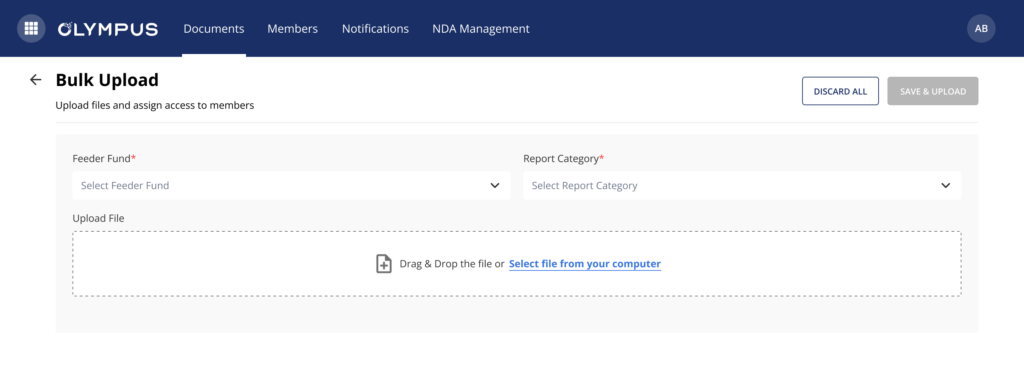

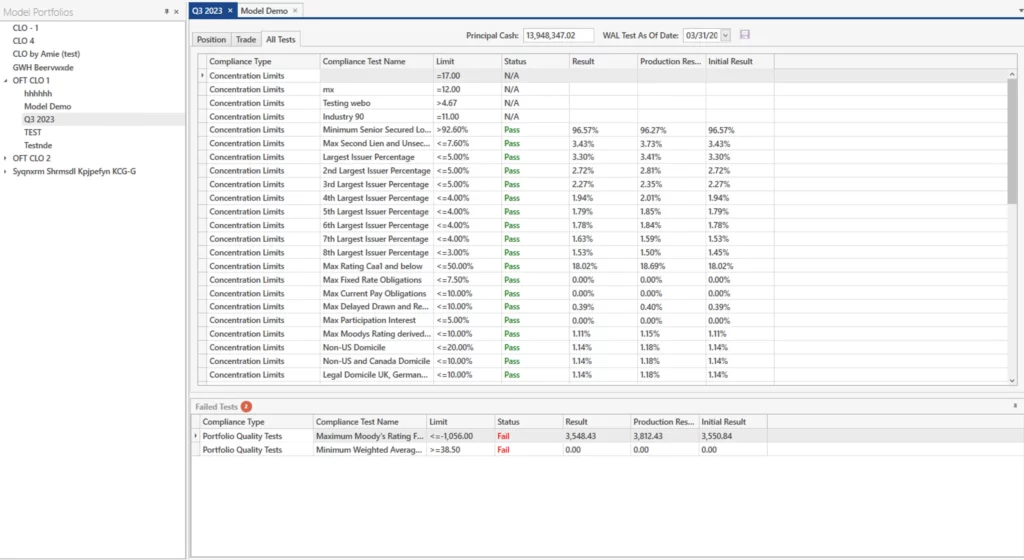

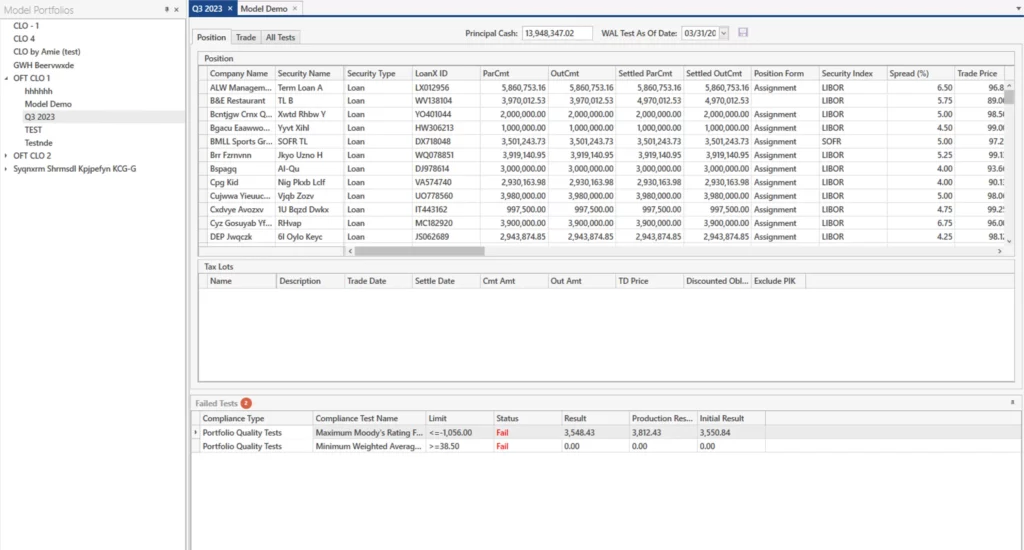

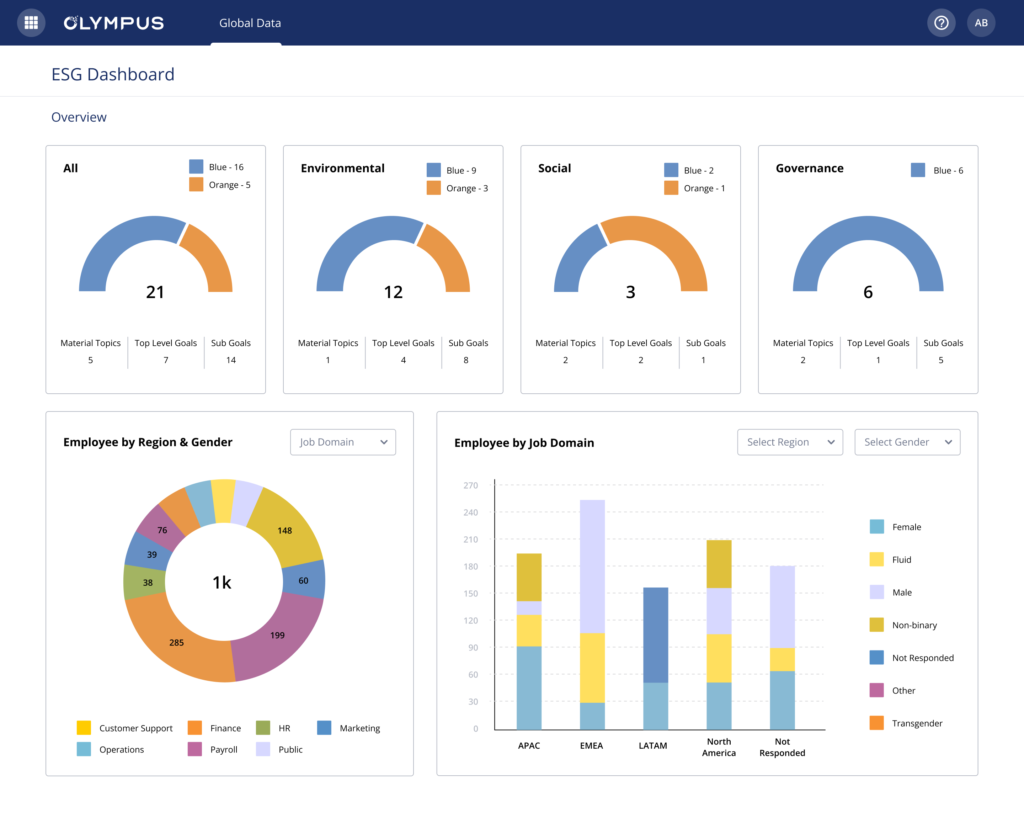

Olympus BI platform for ESG Data Reporting

To streamline ESG data reporting, many businesses are turning to specialized platforms like Olympus BI.

Olympus BI is a comprehensive business intelligence platform that enables businesses to track, analyze, and report on their ESG performance effectively.

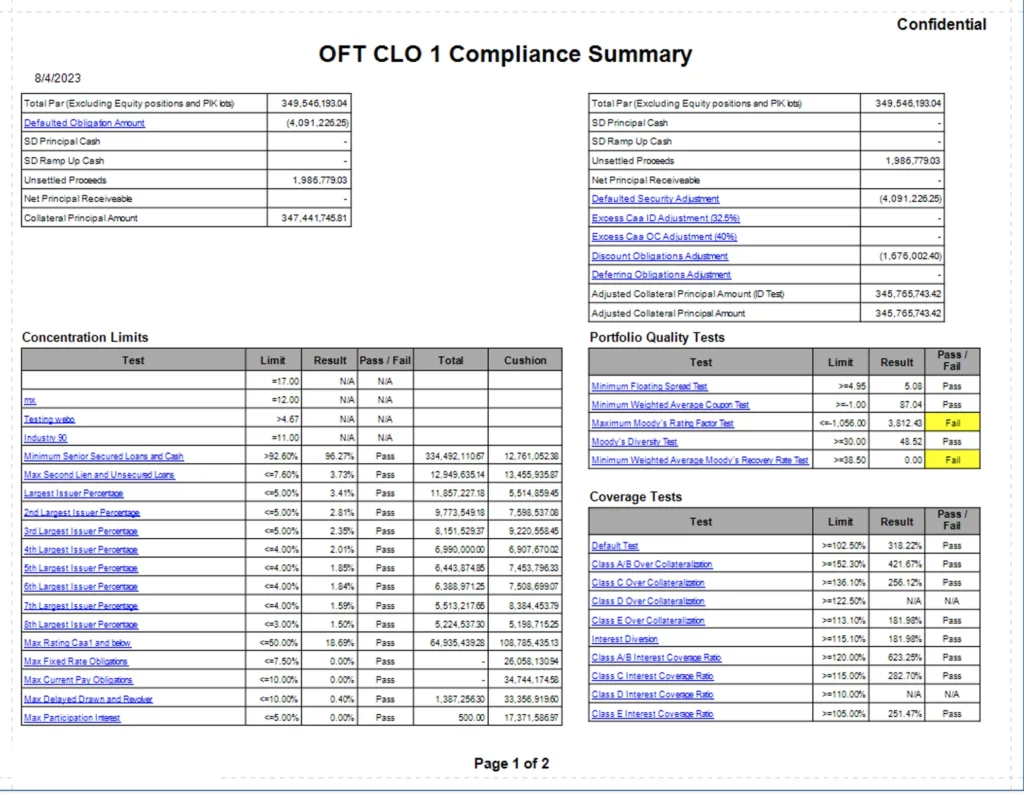

This platform offers a comprehensive solution to enhance ESG Data Reporting, allowing you to seamlessly integrate Environmental, Social, and Governance metrics. The process involves configuring ESG data efficiently, generating valuable portfolio simulations, and closely monitoring compliance.

With advanced analytics tools, the platform visually represents performance metrics, empowering you to make informed investment decisions that align with sustainable values.

Dedicated KPI Reporting with Olympus BI

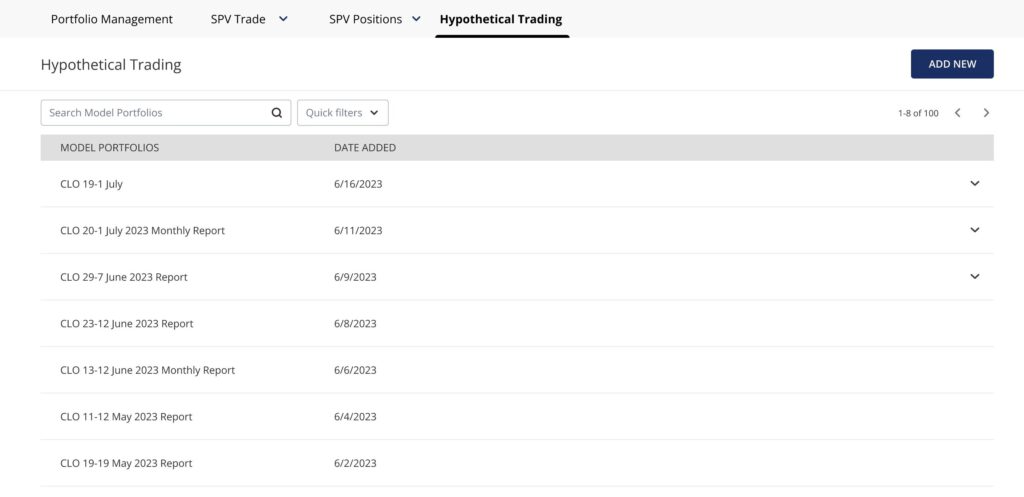

Leveraging Olympus BI for dedicated ESG KPI reporting is a strategic move that can greatly enhance your decision-making process and drive optimal outcomes. Here’s how to do it effectively:

- Identify Key Metrics: Define the essential Key Performance Indicators (KPIs) that align with your business objectives.

- Real-Time Tracking: Utilize Olympus BI to seamlessly set up and monitor these KPIs in real-time, ensuring you’re always up-to-date with performance.

- Visual Insights: Access dynamic dashboards and visualizations provided by Olympus BI. These tools offer a comprehensive overview of your performance against critical benchmarks.

- Informed Decisions: Leverage the insights generated by dedicated KPI reporting to make well-informed, data-driven decisions that positively impact your strategies.ons provided by Olympus BI. These tools offer a comprehensive overview of your performance against critical benchmarks.

- Agility and Adaptability: Use the real-time data from Olympus BI to quickly pivot and adjust strategies based on the current performance of your KPIs.

- Optimized Outcomes: By effectively leveraging dedicated KPI reporting through Olympus BI, you can optimize your business outcomes, achieving growth, efficiency, and success by aligning your actions with the insights gained from KPI analysis.

Olympus BI Integrated with JIST: Better KPI Tracking

For businesses seeking even greater efficiency and accuracy in ESG KPI tracking, Olympus BI can be seamlessly integrated with JIST.

JIST is a multi-entity BI platform engineered to empower organizational decision-making. It enables seamless parent-child reporting relationships and provides comprehensive dashboards for tracking financial and business KPIs. Integrating Olympus BI with JIST presents a powerful synergy for enhanced ESG KPI tracking and informed decision-making.

By seamlessly merging these platforms, you can achieve the following:

- Unified Data: Consolidate data from both Olympus BI and JIST, ensuring a comprehensive view of business metrics and KPIs.

- Comprehensive Analysis: Leverage Olympus BI’s analytical capabilities to delve into KPI trends and patterns from JIST’s multi-entity reporting.

- Real-time Insights: Benefit from real-time updates provided by JIST’s parent-child reporting relationship, while Olympus BI’s visualizations offer dynamic insights.

- Informed Decisions: Merge data to get a comprehensive understanding of KPI performance, enabling smarter decision-making.

- Customized Dashboards: Create tailored dashboards using Olympus BI’s tools, presenting integrated data from JIST in a user-friendly manner.

- Strategic Alignment: The integration empowers you to align your strategies with real-time KPI performance, yielding better results.

Integrating Olympus BI and JIST streamlines KPI tracking, offering a unified, data-rich environment. This integration empowersyou to make impactful decisions, ultimately enhancing business performance and success.

Conclusion

ESG investing is a powerful tool for aligning investments with sustainable and responsible practices. By understanding the key factors that underpin ESG investing, tracking critical ESG KPIs, and leveraging platforms like Olympus BI, businesses can embrace sustainable investment practices and demonstrate their commitment to environmental, social, and governance performance.

Book a demo of Olympus BI today and take the first step towards sustainable ESG investing.