A look into the Collateralized Loan Obligations (CLO) market for 2023-24. How advanced AI and technology solutions like Olympus are revolutionizing management tactics, enhancing performance, and reshaping the financial ecosystem for both investors and managers.

Collateralized Loan Obligations (CLOs) have been growing in popularity since their inception in the late 1980s. Many investors now swear by Collateralized Loan Obligation due to above-average returns, solid risk profiles, and the potential for significant upside appreciation.

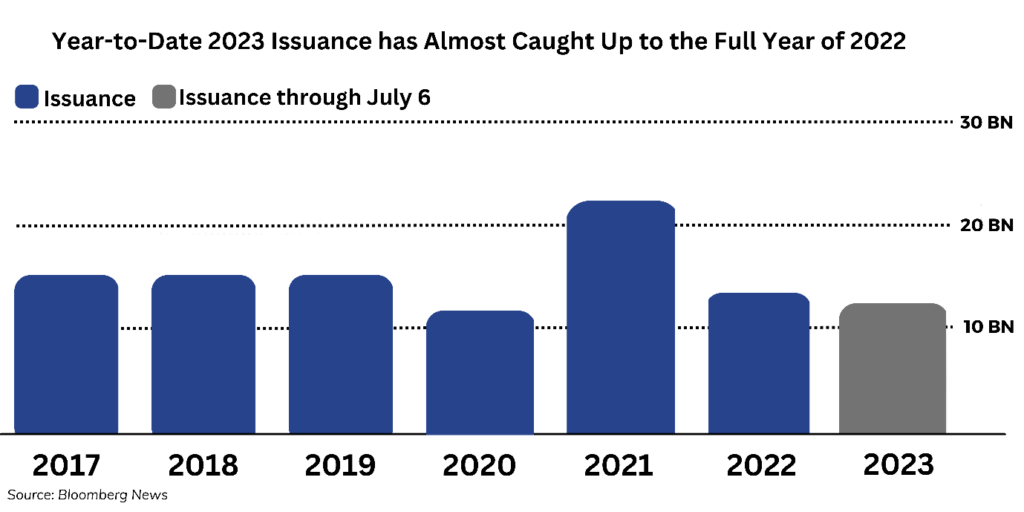

In fact, Middle market CLO issuance has reached record highs due to interest in the private credit market, in the first half of 2023.

Interestingly, $11.4 billion worth of CLOs were issued in the first half of 2023, accounting for 21% of all new issuance as opposed to 7-14% in the first half of 2016–2022.

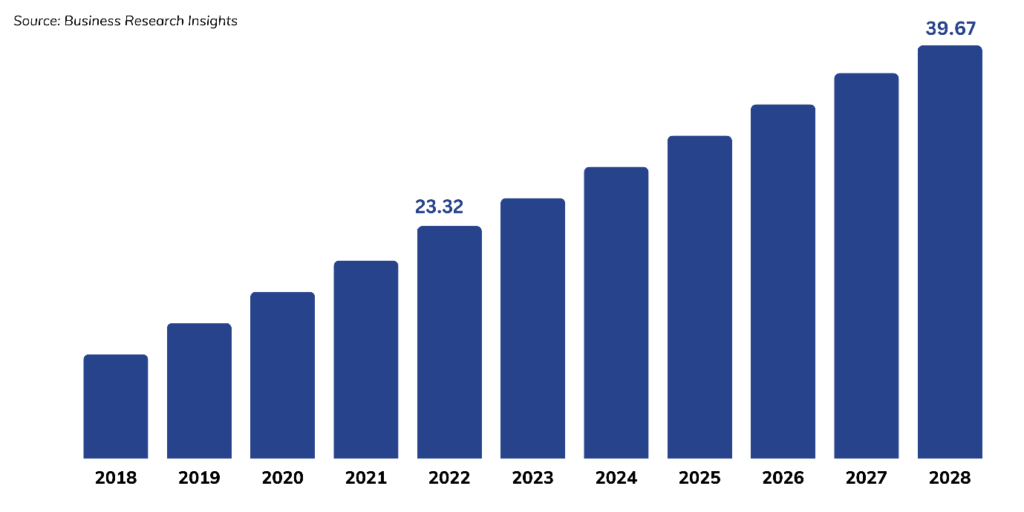

And that’s not all: The global collateralized loan obligation (CLO) market is likely to grow at a compound annual growth rate (CAGR) of 9.26% to be worth USD 39.67 billion by 2028.

A significant portion of the ever-increasing popularity of Collateralized Loan Obligations (CLOs) can be ascribed to technical innovation and disruptions that have enhanced its performance and made it more generally sought after.

Collateralized Loan Obligations are being combined with various technologies such as Blockchain, Artificial Intelligence (AI), and Machine Learning (ML) to streamline the entire process in today’s digital age.

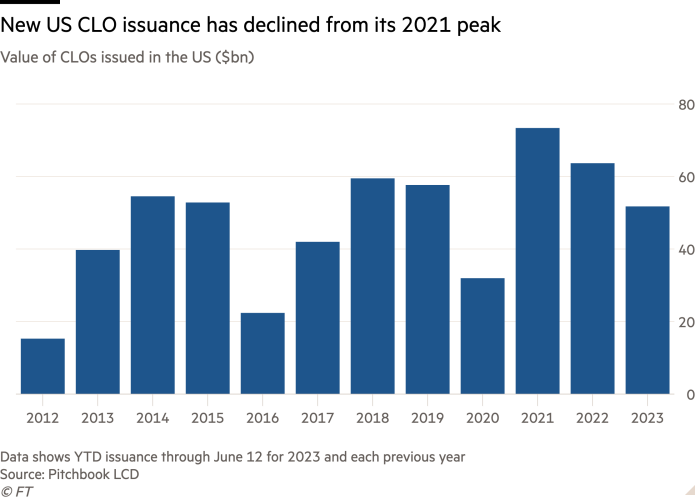

While the first half witnessed market volatility and a substantial increase in Middle market CLO issuance, the Q4 2023 collateralized loan obligation (CLO) market is facing challenges with a decline in issuance and rapidly changing market dynamics.

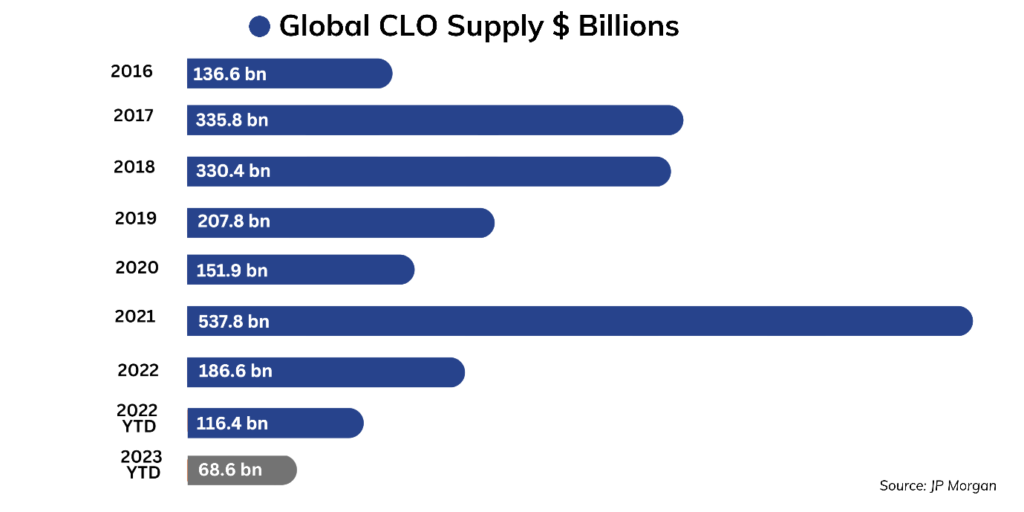

Declining CLO Issuance: The pace of issuance of collateralized loan obligations has stalled due to aggressive rate hikes and tougher borrowing conditions.

JP Morgan data reveals that specialist asset managers issued CLOs worth over half a trillion dollars in 2021, but only around $69 billion were launched or refinanced in the first half of 2023, down 41% compared to the same period in 2022.

Decreasing Demand for Junk Loans: CLOs are popular with hedge funds, insurers, and asset managers seeking higher yields in a low-cost borrowing environment. However, these vehicles, which account for up to 60% of demand for single B or below-rated junk loans, are experiencing a slowdown. Demand for the bonds issued by CLO solutions is expected to decline leading to potential higher default rates, according to S&P Global Ratings.

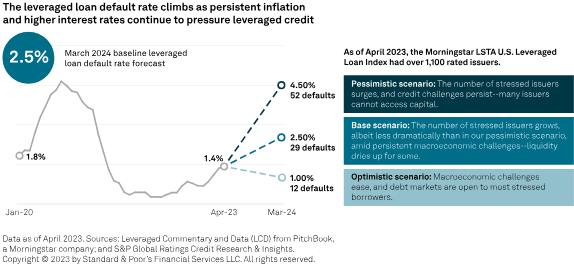

Rising Debt Defaults: The market faces storm clouds as companies with speculative debt are confronting a mountain of refinancing needs amid the sharpest rise in global interest rates in decades.

Debt defaults are already on the rise, exposing flaws in business models underlying loans that were previously supported by a plentiful money supply and low interest rates. S&P Global estimates that more than 1 in 25 U.S. businesses and European companies will default by March 2024.

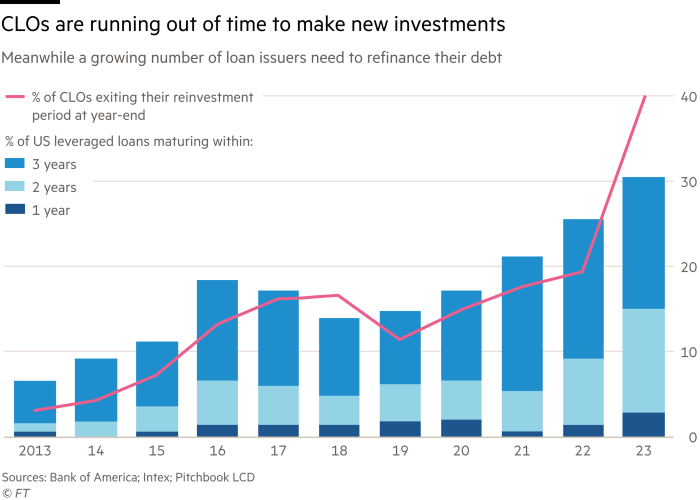

Expiration of CLOs: According to Bank of America, roughly 38% of existing CLOs will reach their expiry date by the end of 2023, reducing their ability to buy new loans and make outstanding debt or payments resulting in loan defaults and a diminishing demand for junk debt tranches.

According to PineBridge Investments, the inability to put together new portfolios due to lower returns and the increasing interest rates will pose potential threats for the CLO market.

To sum it up: The Collateralized Loan Obligations (CLO) market is facing significant challenges in Q3 and Q4 2023, with declining issuance, decreasing demand for junk loans, rising debt defaults, and uncertainties for high-risk borrowers. The expected slowdown in CLO issuance, coupled with higher default rates, poses risks for both investors and borrowers in the market.

As investors in the CLO market demand higher payouts to compensate for lending to weaker borrowers, it has become more important than ever for fund managers to navigate through the challenges in CLO management.

Here are some of the key challenges that fund managers are faced with in 2023:

As the CLO market faces declining issuance, decreasing demand for junk loans, and rising corporate debt defaults in Q3 and Q4 2023, emerging technology would be crucial to address the challenges, mitigate risks in CLO management.

Amidst the challenges faced by the Collateralized Loan Obligations (CLO) market in 2023-24, technology solutions have emerged as a vital catalyst in mitigating these obstacles and making CLO management easier and fund managers more effective.

Adoption of innovative technology equips CLO market participants to navigate uncertainties, optimize risk management, and capital structure and improve performance and resilience in credit markets.

Several technology solutions platforms cater to CLO management needs, offering sought-after features for asset managers and investors. 4 such prominent platforms are:

| Features | eFront | Allvue | WSO | Olympus |

| Overview |

Alternative investment management platform focusing on CLOs, private equity, and real estate.

|

All-in-one investment management software handling various asset classes, including CLOs.

|

Popular investment management platform for various financial instruments, including CLOs.

|

Technology platform specialized in CLO data management and compliance monitoring.

|

| Advantages |

|

|

|

|

| USPs |

|

|

|

|

| Additional Features |

|

|

|

|

The Collateralized Loan Obligations market in Q3 and Q4 of 2023 is expected to experience volatility driven by economic indicators, inflation, and market conditions. To equip fund managers with the tools needed to navigate through these intricate and uncertain times, Olympus presents a comprehensive suite of features tailored to empower and guide them to monitor and trade their CLO portfolios effectively.

Enhanced Treasury Management: Fund managers benefit from Olympus’ comprehensive treasury management tools, enabling effortless configuration and steadfast maintenance of Collateralized Loan Obligations. The platform facilitates easy reconciliation with trustees and generates portfolio simulations, empowering fund managers to make informed decisions and optimize CLO performance.

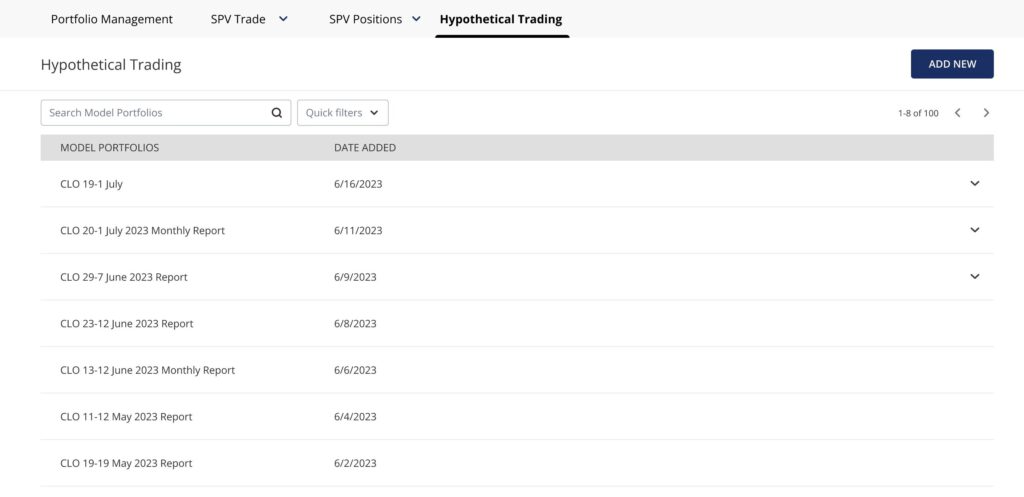

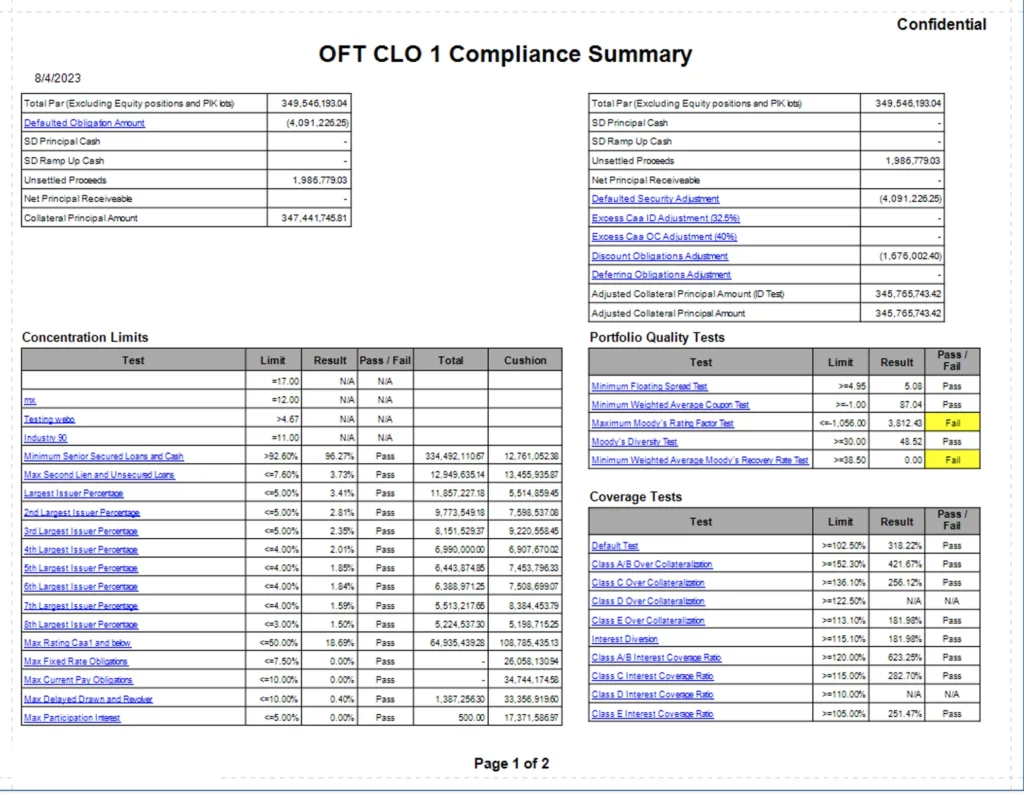

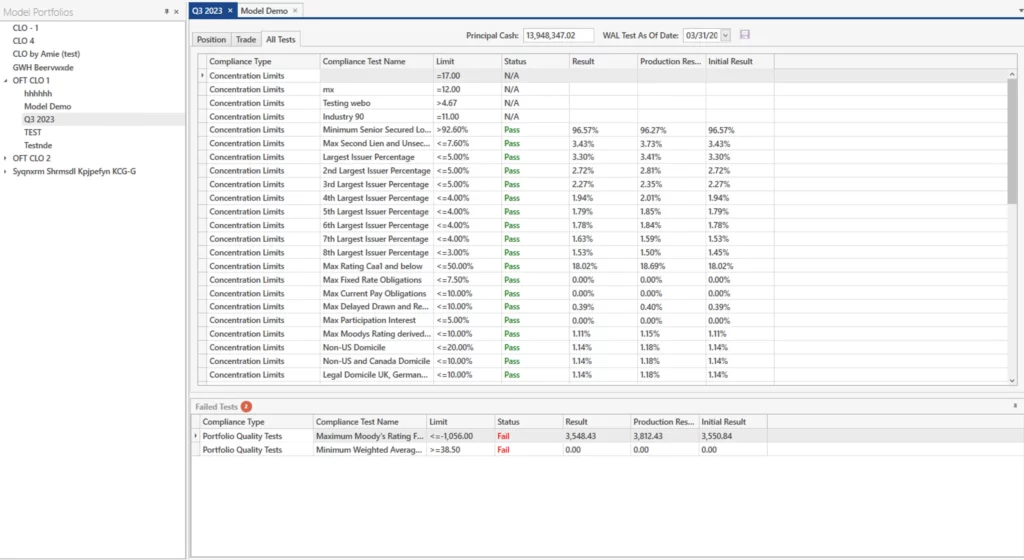

Automated CLO Compliance: With automated indenture creation, test patterns, hypothetical testing, and loan integration & administration, Olympus achieves excellence in CLO compliance management. This functionality assures regulatory compliance, reduces manual effort, and mitigates compliance risks, providing a competitive advantage over competitors.

Data-Driven Decision Making: Olympus uses modern data analytics and machine learning algorithms to deliver deeper insights into market trends, borrower profiles, and credit risk and assessments to fund managers. This enables managers to make informed investment decisions, identify hazards proactively, and optimize risk management measures.

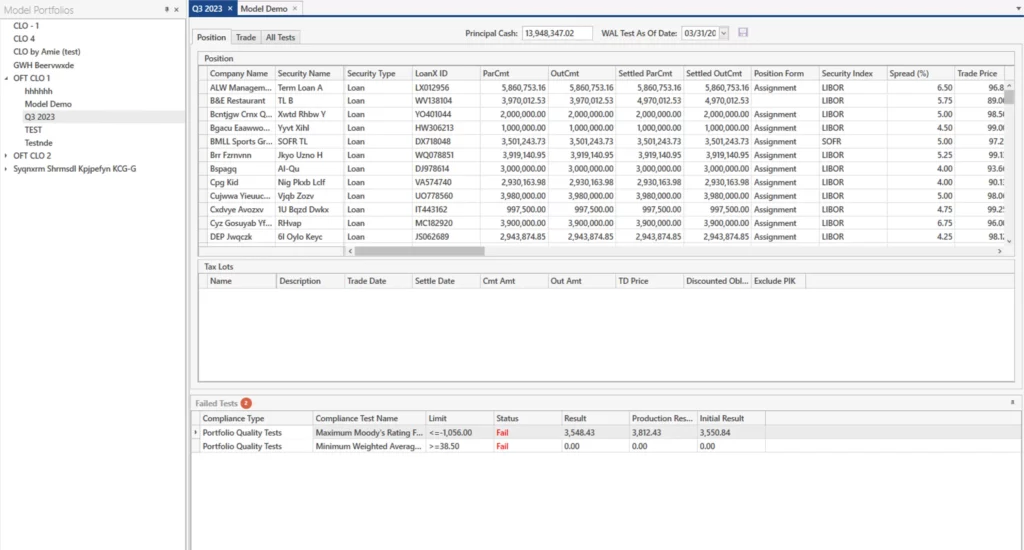

Automated Trading and Settlement: Olympus simplifies the loan, bond, and equity tranche and trade process with its automated trading and settlement capabilities. Fund managers can efficiently process trade tickets and manage pre-settlement and settlement activities, enhancing operational efficiency and reducing processing time.

Seamless Third-Party Integration: Olympus stands out with its seamless integration capabilities, enabling easy integration with leading platforms such as Bloomberg, Tableau, CME Group, Box, IDC, S&P Global, IHS, Azure, and Office 365. This integration provides fund managers with real-time data and analytics from various platforms, improving decision-making and optimizing strategies in the evolving dynamics of the Collateralized Loan Obligations market.

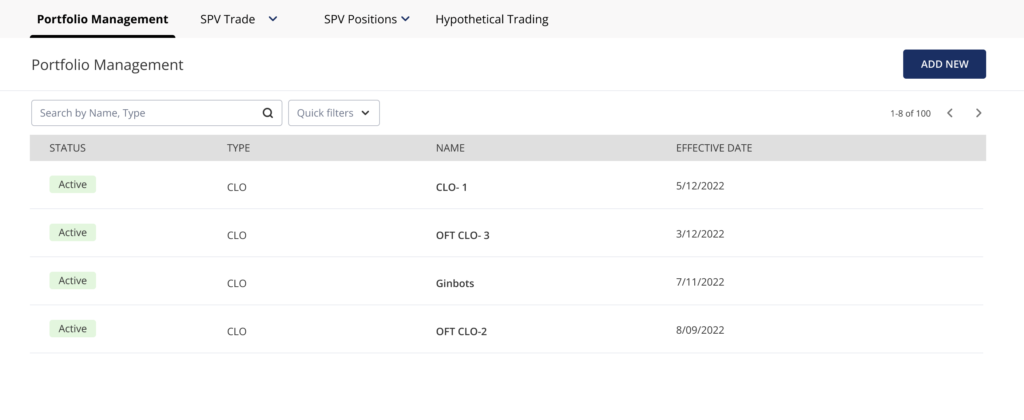

Streamlined Portfolio Management: Olympus sets itself apart with its efficient deal lifecycle data and interactions management. Fund managers can effortlessly monitor position activity and performance, gaining valuable insights for portfolio optimization and risk assessment. The fully mobile platform, driven by frictionless workflows and automation, ensures ease of use and maximizes productivity.

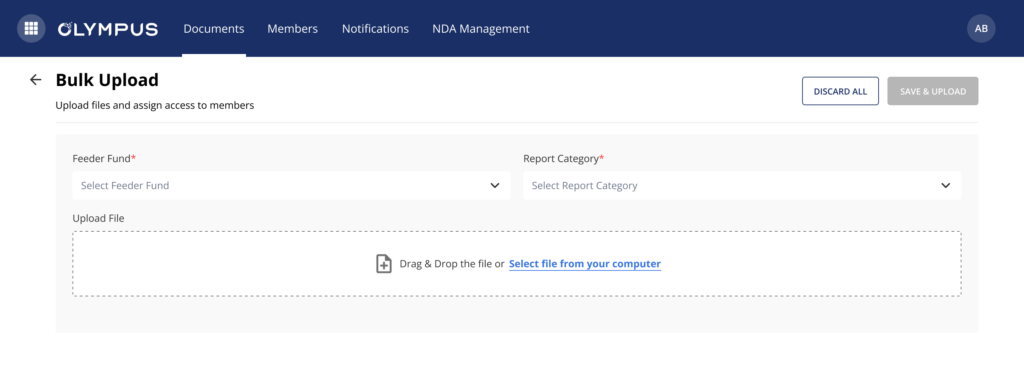

Efficient Investor Relations: With Olympus, managing the capital raising process becomes seamless, from prospecting to close. Fund managers can streamline account management, capital calls, distributions, and account statements, ensuring transparent and smooth communication with investors.

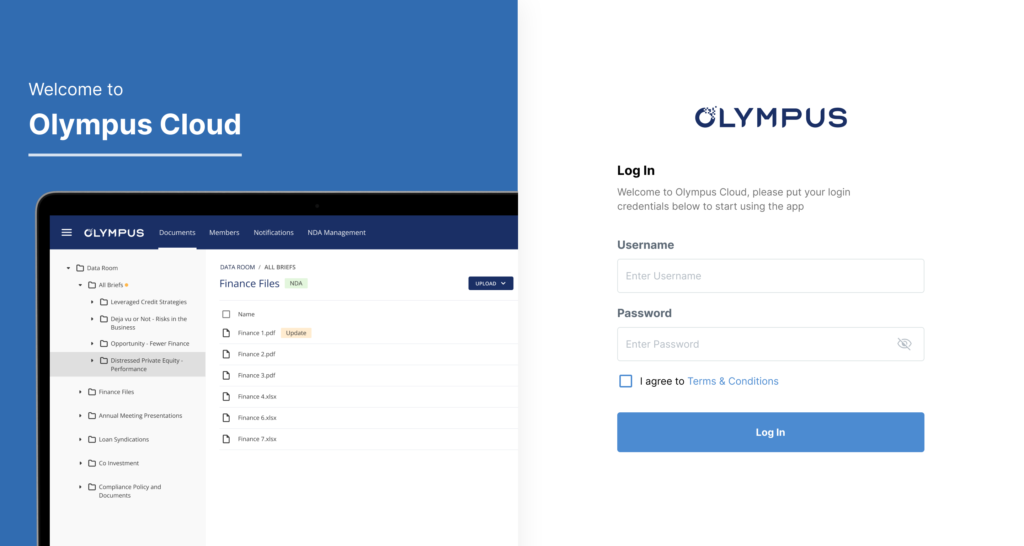

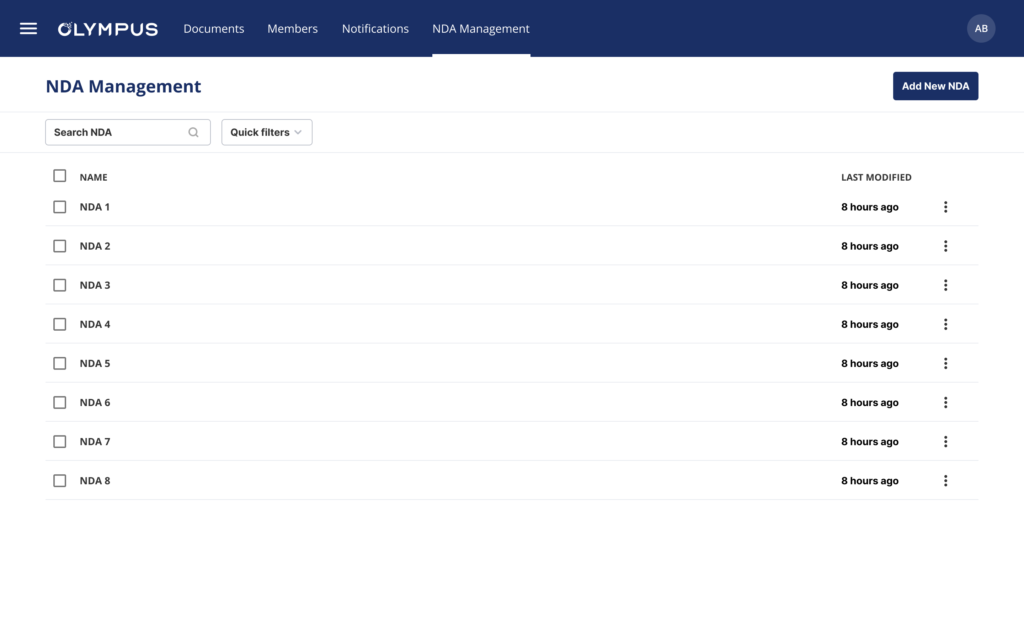

Olympus Data Room: Unlike competitors, Olympus offers a next-generation, secure online document repository tailored to the needs of fund managers. Its encrypted storage ensures the utmost data security, while 24/7 service and support guarantee uninterrupted access. Customization options enable seamless integration with existing systems, streamlining document storage and sharing for due diligence, investor relations, and compliance support.

Collateralized Loan Obligations (CLOs) are a complex but lucrative asset class that can offer investors attractive returns and diversification benefits. However, CLOs also face many challenges and risks in the current market environment, such as rising interest rates, underlying loan payments, and credit quality, higher defaults, and regulatory uncertainty.

To overcome these hurdles, collateralized mortgage obligation, CLO managers and investors need to leverage the power of technology to enhance their portfolio management, risk analysis, compliance monitoring, and reporting capabilities. By embracing innovation and digital transformation, a collateralized loan obligation manager can stay ahead of the curve and thrive in the future.

In Q3 and Q4 of 2023 where the CLO market is likely to be volatile, Olympus can prove to be a powerful ally for fund managers. Olympus can help investors in Collateralized Loan Obligations tap into new sources of capital and liquidity, such as digital platforms, blockchain, and tokenization.

With its advanced technology solutions, streamlined portfolio management, and seamless integration capabilities, Olympus empowers managers to make informed decisions, navigate challenges, and optimize performance, ultimately leading to greater success in the ever-evolving CLO landscape.

To learn more about Olympus and its technology-driven approach to investing in Collateralized Loan Obligations, schedule a product demo or make an inquiry today.