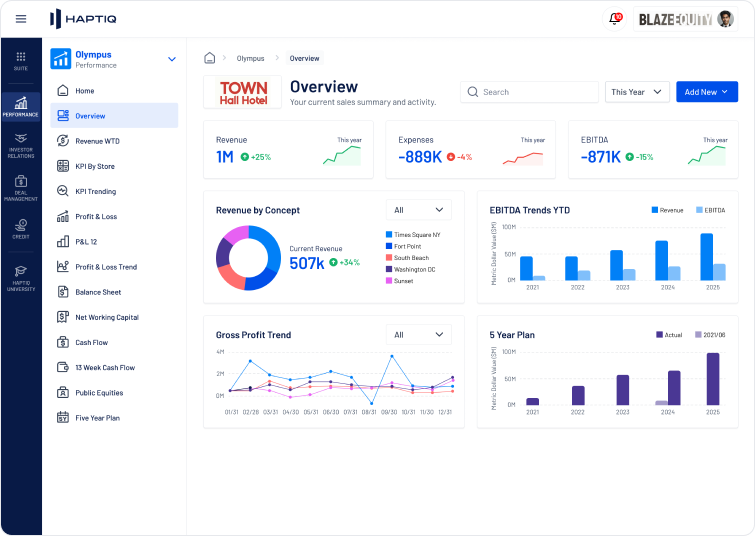

Performance Attribution

Olympustm Performance

With the Olympus Performance module, our private equity software empowers Private Equity firms to embark on a journey of unparalleled financial clarity and strategic execution. The Olympus Performance private equity portfolio management software module not only facilitates meticulous analysis of financial metrics within portfolio companies but also heralds a new era of investor confidence through its advanced alert systems and automated reporting. By enabling a comprehensive understanding of investment returns and adherence to strategic benchmarks, Olympus fosters a culture of precision and excellence. The result is a tangible improvement in decision-making quality, underpinning sustained investment success and enhancing portfolio growth.